SkyThread for Parts (TM)

Welcome to 2023!

By Chuck Marx, SkyThread Chief Strategy Officer

Note: this post is part of a 52-week series Chuck is posting about digital aviation. This post is Week 1.

Blockchain for Aviation assets will see real progress this year. I’ve been building towards this vision over the past 20 years and have supported the commercial and defense aviation industry for over 40 years. Why in 2023? Gartner has placed blockchain into the “Slope of Enlightenment”. It’s taken about 10 years to arrive here, having gone through the “Trough of Disillusionment”, the “Peak of Inflated Expectations” and the Innovation Trigger”.

I’m Chuck Marx, the Chief Strategy Officer and co-founder of SkyThread. I’ve been involved in the digital transformation in the industry since 2003. Back then, and to a large extend now, the aviation industry relied on manual work efforts, supplemented by “point to point” technology solutions to link, but not integrate business processes. The data required to “know” the status of an aircraft part and “know” the real time configuration of an aircraft is elusive. Way back in 2005, I ‘imagined” the day when we would have “Data for the Life of the Aircraft. We’re almost there.

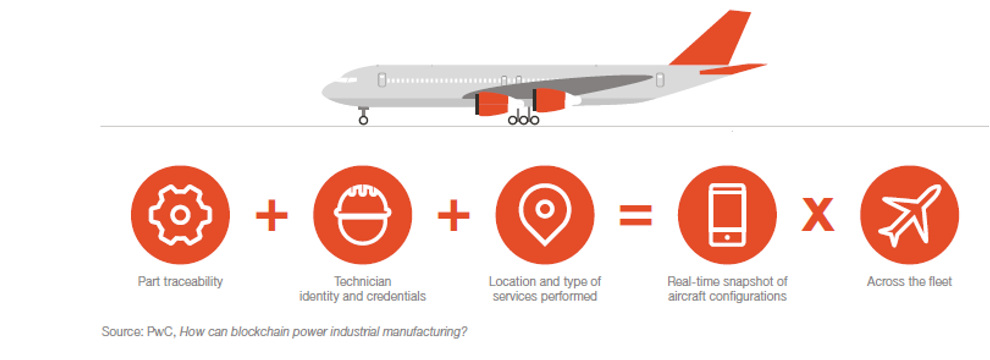

Keeping a plane flying (commercial) or mission ready (defense) requires the deep skills of engineers, technicians, repair facilities and supply chain experts at dozens of companies over the life of the aircraft. Parts move between tail #’s, between airlines and repair stations. Knowing the history of these parts as they move is mission critical and gaps in provenance and history are more common than not. We’re now building the “business ecosystems” of companies and actors to collaborate in a trusted, distributed manner to get the right part, to the right place, on the right plane at the right time by the right person.

Over many decades, we’ve built industry safety factors to protect against these data and trust inadequacies, our aged information systems, and process weaknesses. But we’re still dealing with significant inefficiency, waste, and delays. We compensate through higher inventory levels, lead times, TAT cushion, block times, headcount, and predictive analysis. All while the complexity of our assets and the missions they fly increase. Net-net, we can do better.

But it’s not about blockchain. It’s about Digital Aviation and building ecosystems.

The Aviation Ecosystem -

I’ve informed my vision for transformational change over the years “piece by piece” and then holistically with the following experiences:

Airframe – Building the process and data models to deliver an aircraft to an airline for induction of the plane into their fleet – key outputs of the PLM and ERP systems. This creates the 1st chapter of the Digital Twin of the aircraft as it moves into “as flown” status. Airframers are all migrating “now” to new ERP/MES systems. All lack true visibility into the real time configuration of the aircraft.

Airline – Induction of the aircraft into the MRO system of the airline along with the Digital Thread of the parts supply chain for spares provisioning and MRO planning. Some of the MRO systems were built almost 40 years ago. Recent mega-mergers in the US have unveiled the large data issues hiding in these MRO systems.

Tier 1 Parts – Unfortunately, many parts come back to the Tier 1 with large gaps in information about how and where that part was used and the cause of return. The ERP systems have been undergoing renovation for the past 20 years.

MRO Providers – in the hangar, on the line and in component repair. The task cards contain high levels of “surprise” when the aircraft pulls into the slot for repairs and parts requirements.

Parts Exchanges – these companies are right in the thick of the USM market where we’re forced to deal with unsecured documentation

Information Systems – I’ve been involved in the re-implementation or conversion of dozens of ERP, MES, MRO, and contemporary digital systems.

These experiences along the entire value chain of the aircraft and its parts led to the formulation of the vision we call “Data for the Life of the Aircraft”

Industry Best Practices -

I had experienced the value of distributed information for aviation assets working on two major defense applications – first, in the UK, the MoD has been building a Fleet Information Management System (FLIS) since 2011 using a consortium of technology providers and professional services firms. Boeing UK was (is) the prime on the contract and my former company, BearingPoint was one of the design consultants. Boeing recently won a $500 million contract to extend the system and begin to “delayer” it’s complicated code structures for eventual replacement in 2027.

Not to restate here the vision, mission, strategy, and goals of this remarkable system here, but this quote from the contract extension provides some insights on why we look to this solution for industry best practices - Boeing won the original FLIS deal in 2010, taking on the role as single delivery partner for logistics information to the MoD. This came into force in 2011, replacing around 120 contracts with more than 50 companies.

“The new deal has been awarded without competition, the MoD saying in a market transparency notice that FLIS services rely heavily on legacy systems and experienced personnel with specialist knowledge who would be difficult to replace from another source. The contract takes in digital systems to support services including inventory, transport and movement, engineering and maintenance and general ledger management. These all have a strong impact on the Armed Forces’ operational capabilities.

Why bring up FLIS? It’s an ecosystem play involving the operator (UK MoD), the aircraft platforms (defense contractors), the Tier 1 parts suppliers and the bases that receive and maintain the aircraft. Why is their only 1 FLIS in the world? It’s expensive, complicated, and effectively “replaced” dozens and dozens of legacy information systems.

We plan to take the best practices from innovations like FLIS and achieve the same outcomes for commercial aviation without replacing legacy systems or making heavy investments in the technology stack, leveraging the contemporary innovations available through Industry 4.0 and Web 3.0.

Lessons learned from the Defense Industry can be applied to Commercial Aviation

Why Blockchain?

I’m not a blockchain guy. As I moved in and around the major ecosystem players highlighted above, I saw that there were “few” options for moving “trusted” data seamlessly between the actors in a distributed way – not in a linear fashion.

At PwC, where I ran Aerospace & Defense, I spent time in London, France, Germany, and Hong Kong studying and evaluating the major emerging technologies for their applicability to our industry. The business problem I brought to be solved, was “Data for the Life of the Aircraft”. So, in this fashion, blockchain found me.

When you really cut through the technology, it’s features and our required use cases in the aviation industry, it’s almost as if blockchain was designed for us.

The industry spawned several firms that are using blockchain to tackle specific use cases. In fact, I was in Hong Kong at the HAECO Blockchain Summit way back in 2019 with the launch of what today is the SITA MRO Alliance. Over 100 people from 30 companies attended this event. We’re also in discussions with IATA, EASA, AIA, IDCA and others on the role of distributed ledger technologies to remediate the hundreds of pain points airlines, MROs, and Tier 1 parts providers face as they work hard to keep our aircraft fleets air worthy.

Many of the blockchain efforts are technology forward. They are almost always built for bilateral use – point to point, much like EDI was deployed 20+ years ago. But the real value lies in using distributed ledgers to achieve triangulation of the data to build trust and encourage participation in the problem solving while also sharing in the rewards of the new outcomes. All our efforts will involve established or new ecosystems to build better business models for the next generation of aviation stakeholders.

Before Blockchain

I’ve lived through the Gartner Blockchain Hype Indices and worked with many technologies along the way.

For the US Air Force, we built an SAP Business Objects on Teradata application that captured aircraft technician data at the time of part removal to share with platform OEM (aircraft) and tier 1 parts makers. The goal was to improve the mission readiness of the aircraft and allow the ecosystem players to earn their contract incentives. It worked. Parts, planes, and technician information was available, as required, to achieve the mission of the aircraft. That system is now 15 years old and running today. This will apply to commercial PBH, PBL, FHS and rotable contracts.

For the UK MoD, as noted above, many companies came together to build a fleet logistics information system that captured planes, parts, people, and places information across the high variety of aviation assets deployed by the MoD. This required a “heavy lift” in terms on systems integration, data modeling and process alignment. Lessons learned will apply to commercial aircraft “Digital Twin” and supply chain “Digital Thread” applications.

At PwC, we completed an industry strategy assessment centered on “Aerospace Information Services”. Over 200 industrial players in the AIS market providing $30 billion in digital services to the commercial aerospace industry and an equivalent $30 billion in digital services to the defense aerospace industry. The market is equivalent to both the delivery of new commercial aircraft each year and the provisioning of material spares into the commercial aftermarket today. AES is a mature industry, but mostly delivered by companies associated with, but “outside” the delivery or aircraft and parts provisioning.

The transition - beginning in 2018, we spent 14 months working in an aviation industry ecosystem that included an airframer, Tier 1 supplier, Global Airline, Global MRO, Parts Broker and DXC (systems integrator) to define industry use cases and data models. We developed an industry blockchain solution built by PwC called AirTrace which demonstrated the technical and operational feasibility of using blockchain to solve data issues and industry pain points. The solution was put into production in Japan for a food service company to continue testing all aspects of blockchain component / ingredient traceability.

The Last 4 Years – Then and Now

Over the past 4 years, our co-founders at SkyThread worked amongst the early adopters of digital aviation in our space, collaborating for the benefit of everyone – We’ve learned a bit from these early ventures:

Airbus SkyWise

Lufthansa Aviatar

Honeywell Go Direct, now Forge

Boeing Digital

GE Predix and other developments

CargoChain – Switzerland

Parts Pedigree – Deloitte heritage

Taking these lessons learned, we formed SkyThread 2 years ago and have completed the $2 million independent “build” of SkyThread for Parts. It’s in deployment planning with a major MRO in a rotable pool of B787 aircraft parts supporting 21 airlines.

With the completion of SkyThread for Parts TM, we’ve begun work on SkyThread for Planes TM and SkyThread for Leases TM.

The pandemic has really forced the industry to re-examine its business models, fleet strategies, supply chain strategies and maintenance protocols. As the industry rebounds, there will be more intense focus on the achievement of simultaneously meeting the often-competing KPI’s – asset availability, inventory reductions, TAT reductions, and reduced MRO costs across the board.

The variation in maintenance costs is extremely wide – with MRO costs per tail within a multi-platform fleet ranging from $2 million to nearly $4 million. With average inventories by tail exceeding $2 million, we’re carrying multiple years of spares on hand. Again, the standard deviations are high on this metric. The IROP recovery costs for the industry are over $30 billion. An almost unthinkable number in terms of cost and passenger disruptions.

We’ll explore all three of these metrics in our blogs this year.

Success Factors

There are successes and lessons learned in all of these. To summarize what is needed for lasting change and industry wide adoption, we see the need for:

Leadership engagement – this is no longer a proof of concept – our senior advisory board at SkyThread include 13 senior industry leaders with lessons learned

Ecosystem engagement – blockchain works best using a cluster concept – point to point solutions up and down the ecosystem still leaves data gaps that impede value

Trust and Transparency – since this is about the aircraft and its parts, we need to work together. Blockchain will NOT infringe on IP, pricing, or other proprietary information

Data integrity – we’re working with the standards bodies to tighten up to data taxonomy, data governance and process models required to effectively share data

Monetization – contributing data to the chain should not be an act of “goodwill”. We’ve created the customer wallet and routines to reward contribution of data through revenues “set aside” from views of that data downstream

Governance – the industry requires a private, permissioned chain. If you have a legitimate role with that part # or tail #, you will be in that node cluster. The IDCA will help establish data self-governance rules for the ecosystem

Integration with legacy systems – despite their shortcomings, the existing PLM, ERP, MRO, MIS and the many “edge” solutions being built, the chain will need to receive, but then “validate” this legacy data

Validation – prior chains have suffered from simply “passing along” suspect or defective data. We’re building the data validation routines to close these gaps

How to Engage

Every company in the industry is part of a linked chain ecosystem. Because of the firewalls that exist within our information systems, we can’t see what we need to see upstream and downstream from where we sit. We are in discussions with 8 ecosystems today that include 3 or more of the following - Airline, MRO, Tier 1 Parts Supplier, Airframe, Engine Company, Brokers / Distributors. We approach the discussions through the lens of a “SIPOC” Supplier – Input – Process – Output – Customer.

No matter where you sit in the ecosystem, bring your SIPOC forward and we’ll discuss.

You can reach us at info@skythread.aero